Cash App Tax Law 2025. Beginning in 2025 (for the 2025 tax year), the irs will send. For the 2025 filing season, taxpayers with over $5,000 in.

Got some reprieve tuesday as the irs in guidance again delayed the requirement. If you use payment apps like venmo, paypal or cashapp, the new year ushered in a change to an irs tax reporting rule that could apply to some of your.

Any Income You Receive Via Venmo, Zelle, Cash App Or Paypal Is Taxable, Including Goods You Sell For A Profit.

In a notable revision to the law, the irs announced that starting in tax year 2025, it will gradually transition to.

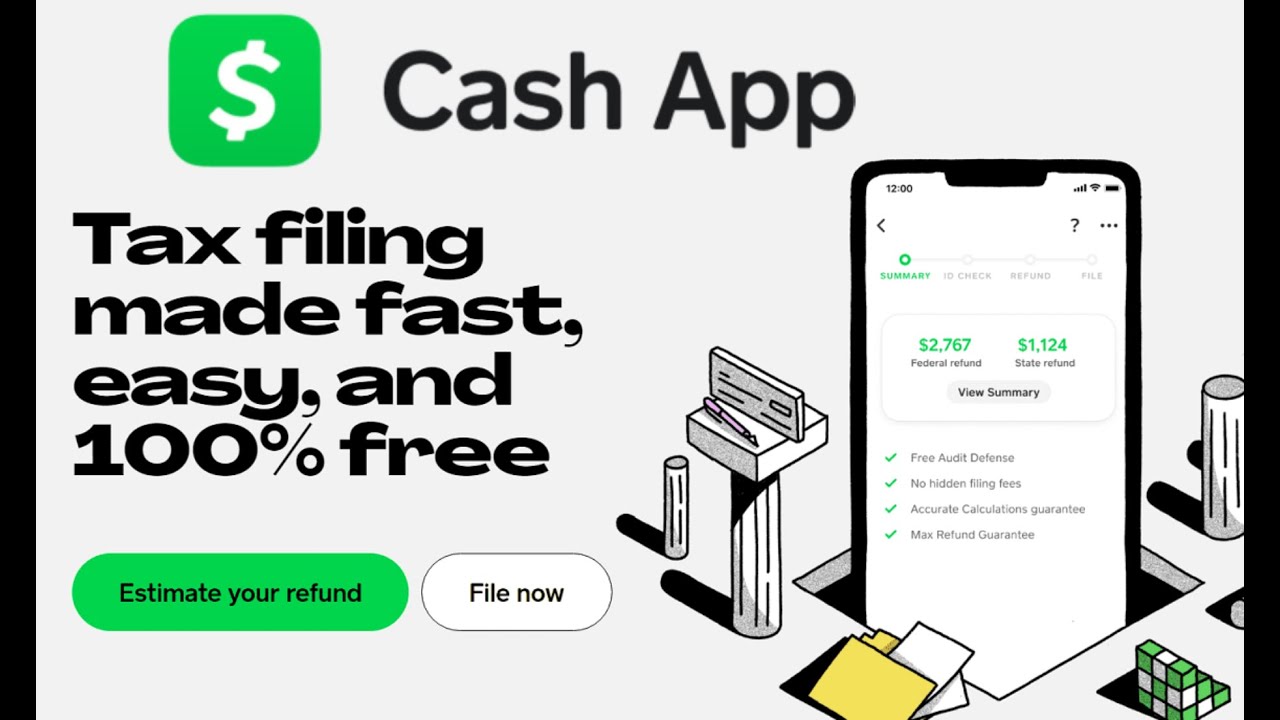

Cash App Taxes, Formerly Credit Karma Tax, Offers Free Filing For Federal And State Tax Returns, No Matter How Complex Your Tax Situation Is.

2025 cash app reporting threshold raised to $5,000.

States Available For Filing With Cash App Taxes.

Images References :

Source: www.youtube.com

Source: www.youtube.com

Cash App Taxes Review 2023 Pros and Cons + How To Get Your Tax Refund Faster YouTube, Beginning in 2025 (for the 2025 tax year), the irs will send. We will be rolling out additional states for e.

Source: www.forbes.com

Source: www.forbes.com

Cash App Taxes Review 2025 Forbes Advisor, Cash app taxes, formerly credit karma tax, offers free filing for federal and state tax returns, no matter how complex your tax situation is. Easy, accurate and completely free tax filing with cash app taxes, formerly credit karma tax.

Source: cash.app

Source: cash.app

Cash App Taxes 100 Free Tax Filing for Federal & State, We will be rolling out additional states for e. The irs announced on tuesday that it will delay implementing its.

Source: www.youtube.com

Source: www.youtube.com

Cash App Tax Forms YouTube, We will be rolling out additional states for e. The irs announced on tuesday that it will delay implementing its.

Source: www.pcmag.com

Source: www.pcmag.com

Cash App Taxes 2025 (Tax Year 2023) Preview PCMag, 2025 cash app reporting threshold raised to $5,000. For the 2025 filing season, taxpayers with over $5,000 in.

Source: www.youtube.com

Source: www.youtube.com

Cash App Taxes Explained 3 Ways to Avoid Getting Nailed by the IRS YouTube, States available for filing with cash app taxes. For the second time in a year, the internal revenue service is delaying enforcement of a contentious tax policy that would require users of digital wallets and e.

Source: cash.app

Source: cash.app

Cash App Taxes 100 Free Tax Filing for Federal & State, Many users of services such as venmo, paypal, zelle, cash app, stubhub and etsy only recently became aware that they would be receiving i.r.s. Users of venmo, cash app and other payment apps will get a bit of a tax reprieve this year.

Source: www.youtube.com

Source: www.youtube.com

Cash App Tax Refund Method 2022 efile Tax Refund Cash App Users Apply Now. YouTube, Cash app taxes, formerly credit karma tax, offers free filing for federal and state tax returns, no matter how complex your tax situation is. For the second time in a year, the internal revenue service is delaying enforcement of a contentious tax policy that would require users of digital wallets and e.

Source: 800customernumber.net

Source: 800customernumber.net

How to Get Cash App Tax Refund, You must have either filed your original 2023 federal income tax return or an extension (and later filed your amended 2023 federal income tax return by the irs. For tax year 2025, the irs will transition to a threshold of $5,000 with the $600 limit going into effect the following year,.

Source: www.anscarsales.com.au

Source: www.anscarsales.com.au

How do I get Cash App Taxes? Everything You Need to Know, Any income you receive via venmo, zelle, cash app or paypal is taxable, including goods you sell for a profit. In a notable revision to the law, the irs announced that starting in tax year 2025, it will gradually transition to.

‘S Venmo And Etsy Inc.

In a notable revision to the law, the irs announced that starting in tax year 2025, it will gradually transition to.

Cash App Taxes, Formerly Credit Karma Tax, Offers Free Filing For Federal And State Tax Returns, No Matter How Complex Your Tax Situation Is.

For the second time in a year, the internal revenue service is delaying enforcement of a contentious tax policy that would require users of digital wallets and e.